The Stanbic Bank Economic Insights Symposium, held at the Serena Hotel in Kampala today, has shed light on Uganda’s economic performance, highlighting the significant role of gold and coffee exports in driving economic growth.

According to Christopher Legilisho, a lead economist with Stanbic Bank Group, goods exports increased by 24.5% year-over-year, reaching a cumulative total of USD 7.16 billion from January to October 2024. This growth was primarily fueled by:

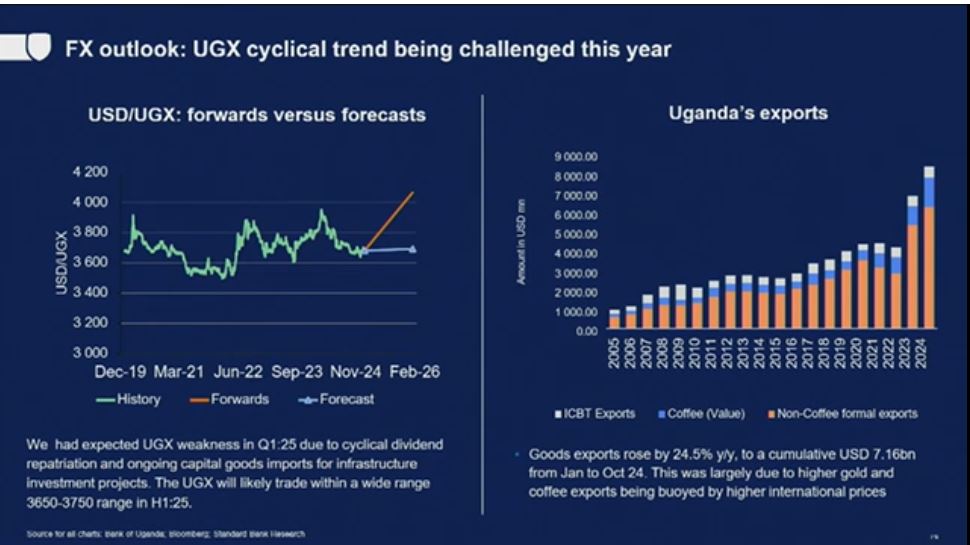

“Goods exports rose by 24.5% year-in-year-out, reaching a cumulative USD 7.16 billion from January to October 2024. This growth was largely fueled by higher gold and coffee exports, buoyed by stronger international prices,” Legilisho said.

Legilisho noted that gold exports surged due to stronger international prices, accounting for a significant share of Uganda’s export earnings, and coffee exports increased, driven by favorable global market conditions and weather.

However, he warned that the weather is likely to be unfavourable this year with prolonged drought in East Africa, which is likely to affect coffee production.

Legilisho also called upon the coffee exporters to be vigilant this year, noting that although the dip in Brazil last year favoured Uganda, the case might not be the same this year because we might experience fluctuations in prices.

He added that, “We had expected the Uganda Shilling to weaken in first quarter of 2025 due to cyclical dividend repatriation and ongoing capital goods imports for infrastructure investment projects. The Uganda shilling will likely trade within a wide range of 3650 – 3750 in the first half of 2025. We still see good imports rising further over 2025 and 2026, largely driven by an increase in capital goods imports associated with the oil sector.”

Economic Outlook

Legilisho explained that the Uganda shilling is expected to trade within a range of 3650-3750 in the first half of 2025, influenced by:

Dividend repatriation: Cyclical dividend payments are expected to impact the shilling’s value.

Capital goods imports: Ongoing imports of capital goods for infrastructure projects, particularly in the oil sector, will continue to shape the country’s trade dynamics.

Implications for Uganda’s Economy

The trends highlighted by Legilisho underscore the complex interplay between imports, exports, and currency movements in Uganda’s evolving economic landscape. As the country prepares for oil production, the growth in gold and coffee exports will remain crucial in supporting economic expansion.

Debt Burden

Legilisho highlighted that Uganda’s economy is ready for takeoff, but to achieve this, the government needs to leverage other sources of income now that U.S. president Donald Trump has since cut off about USD700 in aid. He noted that Uganda should consider securing a new programme from the International Monetary Fund (IMF) and consider other avenues of obtaining funding from the World Bank because borrowing locally through bonds is not sustainable when it comes to servicing the national debt burden.

Uganda’s economic growth is poised to continue, driven by the robust performance of gold and coffee exports. As the country navigates the challenges and opportunities presented by oil production, it is essential to maintain a diversified export base and invest in strategic sectors to ensure sustainable economic growth.