In a bid to safeguard the interests of shareholders, the Capital Markets Authority (CMA) of Uganda has introduced stringent regulations regarding the appointment or replacement of Chief Executive Officers (CEOs) in companies operating within the country. This move is aimed at maintaining confidence in the safety of Uganda’s capital markets.

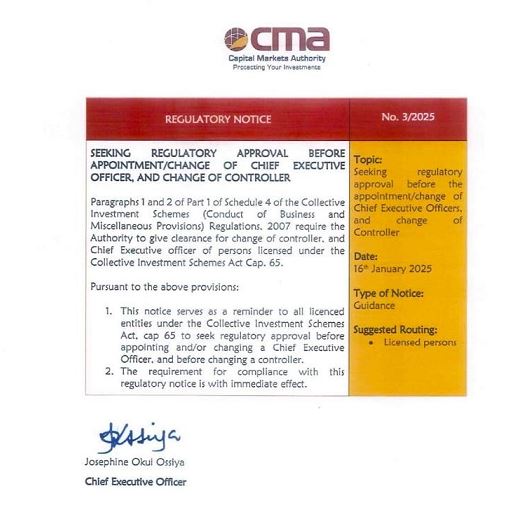

According to a public statement issued by Josephine Okui Ossiya on Monday, February 10, 2025, companies intending to change or appoint new CEOs must adhere to a clearly stipulated process. The CMA has emphasized that regulatory approval is mandatory before appointing or changing a CEO, as well as before changing a controller.

The new regulations serve as a reminder to all licensed entities under the Collective Investment Schemes Act to seek regulatory approval prior to making any changes to their CEO or controller. This requirement is effective immediately, ensuring that companies comply with the CMA’s guidelines to protect shareholder interests.

The CMA’s decision is in line with its commitment to maintaining confidence in the safety of Uganda’s capital markets. By regulating CEO appointments and changes, the CMA aims to prevent potential financial losses and ensure that companies operate transparently and accountably.

Key Implications of New Regulations

Enhanced Transparency

Companies must seek regulatory approval before appointing or changing a CEO, promoting transparency in corporate governance.

Accountability

The CMA’s regulations hold companies accountable for their CEO appointments and changes, ensuring that these decisions are made in the best interests of shareholders.

Protection of Shareholder Interests

The new regulations prioritize the protection of shareholder interests, preventing potential financial losses and maintaining confidence in Uganda’s capital markets.

By introducing these regulations, the CMA demonstrates its commitment to safeguarding the interests of shareholders and promoting a stable and transparent capital market in Uganda.