The rope-pulling between the Government of Uganda and Umeme is not about to end; the latest twist in the saga is that Umeme now demands USD 292M (approximately Shs1,062,885,840,000) as the total claim for its buyout.

It should be noted that Umeme was replaced by the Uganda Electricity Distribution Company Limited (UEDCL) as the national power supplier in May this year, following the expiry of its concession agreement on April 31st, 2025.

Following the takeover by UEDCL, the Government secured a loan of USD118 (approximately Shs429,522,360,000) from Stanbic Bank as the buyout amount for Umeme for the investments undertaken during the 20-year concession.

However, the Umeme Board of Directors raised a dispute over the amount, arguing that USD118 was so minimal to cater for the demands of their shareholders, compared to what the company had invested.

Umeme thus referred the arbitration matter over the actual amount of the buyout to London, and according to a statement issued on June 2, 2025, the company now demands Shs1,062,885,840,000 (USD292M).

Umeme Demands More

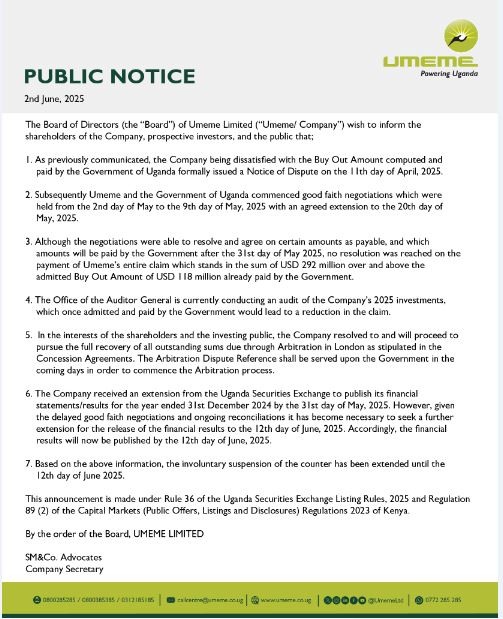

The Umeme statement reads in part, thus;

“…..As previously communicated, the Company, being dissatisfied with the Buyout Amount computed and paid by the Government of Uganda, formally issued a Notice of Dispute on the 11th day of April 2025.

Subsequently, Umeme and the Government of Uganda commenced good faith negotiations which were held from the 2nd day of May to the 9th day of May, 2025, with an agreed extension to the 20th day of May, 2025.

Although the negotiations were able to to resolve and agree on certain amounts payable, and which amounts will be paid by the Government after the 31st day of May 2025, no resolution was reached on the payment of Umeme’s entire claim which stands in the sum of USD292 million over and above the admitted Buyout Amount of USD118 million already paid by the Government.

The Office of the Auditor General is currently conducting an audit of the Company’s 2025 investments, which, once admitted and paid by the Government, would lead to a reduction in the claim.

In the interests of the shareholders and the investing public, the Company resolved to and will proceed to pursue the full recovery of all outstanding sums due through Arbitration in London as stipulated in the Concession Agreements. The Arbitration Dispute Reference shall be served upon the Government in the coming days to commence the Arbitration process…”

The statement also reveals that following this development, Umeme has since secured permission from the Uganda Securities Exchange (USE) to further extend its counter until June 12, 2025, to publish its financial statements/results for the financial results for consideration by the shareholders.

Umeme’s Shs1 Trillion Claim Causes Uproar

However, it is important to note that Umeme’s demands of over Shs1 trillion as the buyout amount have raised eyebrows among Ugandans, with many of them regarding it as some sort of heist.

This is because, among other issues, although the Government paid Umeme USD118M as the buyout amount, the company owes the Uganda Electricity Transmission Company Limited (UETCL) a whopping Shs513 billion, money that was accrued in power that was generated and transmitted to the national grid but not paid for.

This shocking revelation was made on May 30th, 2025, during a session of the Committee on Commissions, Statutory Authorities, and State Enterprises (COSASE) on May 28, 2025, while reviewing the Auditor General’s December 2024 report.

The report showed that UETCL’s receivables had risen to Shs662.840 billion in FY2023/24, up slightly from Shs665 billion in FY2022/23, with the bulk of unpaid funds owed by Umeme.

During the session, Makindye West MP Allan Ssewanyana questioned why the government proceeded with the buyout payment without first settling Umeme’s outstanding debt to UETCL.

“In their response, they confirmed that Umeme owes over Shs500 billion, and Shs84 billion of that is overdue by more than 90 days,” Ssewanyana said, adding, “Yet Parliament approved a USD112 million payment to Umeme. How is UETCL handling this?”

However, Joshua Karamagi, the UETCL Chief Executive Officer (CEO), explained that the Power Sales Agreement with Umeme contains safeguards for the government to recover the funds, even post-contract.

“Our commercial relationship with Umeme is governed by a power sales agreement, which provides dispute resolution mechanisms during and after their operations,” Karamagi said.

“We are pursuing recovery through these provisions, including arbitration,” he added.

Karamagi also argued that UETCL had attempted to block the buyout payment but was constrained by the agreement, which grants Umeme up to 45 days to settle invoices, even on the last day of its operations.

On his part, UETCL’s Commercial Manager, Jenkins Miiro, told Parliament that UETCL had alerted the Capital Markets Authority and Uganda Securities Exchange about Umeme’s debt, given that the company is listed on the stock exchange.

Meanwhile, our efforts to secure a comment from Umeme over the matter were futile after our calls to their office lines went unanswered.