Social media is transforming banking relationships in very significant ways, from improving customer service to allowing users to send money to others via online platforms. New financial technology companies are using social media data to help people get access to credit or even simply open a bank account. Social media can even impact your ability to get a loan. Integration is happening so quickly, it is possible to argue that social media platforms may be the banks of the future.

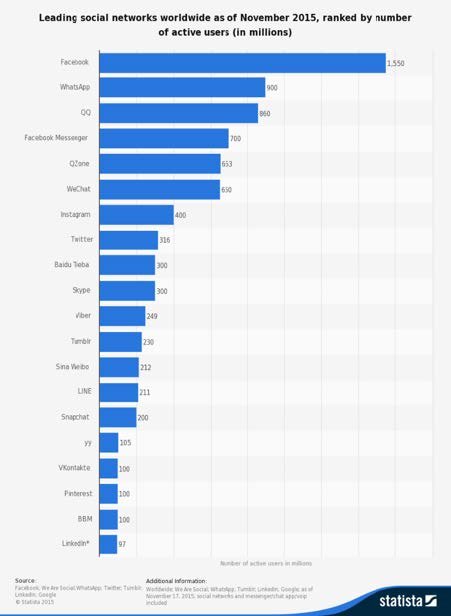

Social media platforms can no longer be considered places where people simply connect and communicate in real-time with the click of a button. Platforms, such as We Chat and Viber in Asia as well as the global powerhouse that is Facebook, are increasingly providing a broad range of services to their users either directly or through partners, making them central to people’s lives.

Such high levels of penetration, use, and engagement have meant that financial institutions are starting to recognize the opportunities social media can bring to their businesses. They are looking to gain a competitive advantage over other institutions while also trying to mitigate the threats posed by social media, such as when people share highly sensitive information publicly.

In addition, regulative complexity and a traditional cultural mindset have meant that until recently, the financial services sector has lagged behind some other sectors in their comprehensive adoption of social media and technology.

But things are moving very quickly. Financial Technology (FinTech) has emerged as its own industry, encompassing companies that use technology to make financial systems more efficient. A report by Accenture and the Partnership Fund indicated that global investment in FinTech ventures has tripled from around $1 billion in 2008 to nearly $3 billion in 2013. Many of these companies are using social media to revolutionize the traditional business models that the finance sector has relied upon for decades.

There are five key areas where social media is changing financial services around the world:

Customer Service

A growing number of customers expect real-time responses from their service providers. When customers are not happy with the service they are receiving and want to vent their frustration, they increasingly turn to public channels, aware that no company wants the negative publicity. Thus more and more banks and insurance companies are adding social media (usually Twitter and Facebook pages) as a permanent channel for retail customer interaction, fully integrated into Customer Relationship Management (CRM) systems. In September 2014, Econsultancy compared the response rates of 16 retail banks on social media in the UK. The quickest response time was three minutes, and the longest was one hour and twenty-four minutes.

This type of public customer service requires caution. The biggest challenge is maintaining security standards when customers unknowingly provide personal information. As a result, banks have had to implement sophisticated social media policies to handle situations with sometimes emotional clients, since conversations that were previously private and one-on-one are now being broadcast for everyone to see.

Marketing

Social media marketing can no longer be disassociated from a company’s overall marketing strategy, forcing them to adopt not only a data-driven approach but also a test-and-learn mindset that can handle a never-changing social environment. According to Accenture, the results are clear: better segmentation, real-time marketing, reduced acquisition costs, and quicker time to market are requirements of a solid marketing strategy.

Many online retail P2P lenders such as Lending Club and Prosper and small business lenders such as Kabbage and OnDeck have grown exponentially by using online and social media as their core marketing channels. More traditional companies are also investing in social media integration. American Express, for example, links a client’s Amex card with his or her social media profiles on platforms such as Facebook and FourSquare and then delivers deals based on activities such as likes and check-ins. The credit card company has won awards for this social innovation.

New Product/Service Development

Social media is not just being used to deliver new products and services, it is also being used to design them. In Turkey, Deniz Bank has revolutionized the banking model by offering banking services through Facebook: customers can connect to their Facebook account and access their bank account to initiate wire transfers and manage daily expenses by monitoring their credit cards. Another example is the Barclay card’s Ring Mastercard, which was developed through crowdsourcing on social media to design and pick the most popular features for the new product.

4. Reducing Costs and Improving Efficiencies In addition to using Facebook to reduce the costs of customer service, banks are using it as an alternative to online banking and an efficient way to process applications. In October 2013 ICICI bank, an Indian multinational banking and financial services company, launched Pockets, a mobile app that allows users to log in to their bank using their Facebook credentials. The app allows users to send money to friends, pay utility bills, recharge mobile phones, and buy movie tickets. The fact that banks are using Facebook credentials to verify identity marks an important turning point for banking institutions.

New Business Models

Chinese social media platforms are leading the way in the exciting area of creating new business models using social media. A useful summary of the scale of this innovation in China is provided here by Bloomberg; an individual can pay their rent using Ali pay from Alibaba, a bank using WeChat’s We Bank and buy mutual funds from Baidu. More than 100 million of the 815 million active users of Ten cent’s QQ messaging service have already integrated their bank cards with the QQ Wallet.

Lenders are now using social media to credit rate applicants, and banks are asking people to use social media for references, meaning more people are receiving loans who would not have been given a second look previously. China has even given Ten cent and Alibaba credit information bureau licenses.

Conclusions

Generally, adoption has been slow, and most traditional banks today have only implemented limited programs, which are often run in isolation from the core business and not as an integrated solution. The opportunities social media provides do not concern only customer service and marketing, but more fundamentally affect the products and services themselves. New business models are changing the entire industry. Large, complex, and highly regulated entities are being forced to learn how to innovate and roll out new ideas in agile ways to test and iterate quickly.

Many of the new players in the financial services sector are still trying to find long-term profitable business models that will stand the test of time. As they grow and time passes, they must be prepared for more regulation. It will also be critical for FinTech companies to build trust, something that banks have not always excelled at. Compliance, security, and privacy will become more prominent as regulators struggle to balance the need to protect consumers and prevent money laundering while enabling greater financial inclusion throughout the world.

Finally, imagine a future where all deposits, payments, remittance, and investment can be handled within social networks in easy and intuitive ways. In this world, cash becomes much less important and the friends you have online can support your path to financial freedom by transferring funds, vouching for you, or supporting your financial goals. The friction that exists across the industry today would be dramatically reduced.

Social media is changing the way the financial services industry operates; the future is bright for increased financial inclusion, lower costs and better customer service. It remains to be seen who will ultimately emerge as the dominant force in finance, the traditional incumbents or the FinTech challengers.

Three Challenges

1. Banks and traditional incumbents must adapt to the new reality that social media is creating. Most have innovation departments, but can they translate their ideas into the core banking services that many new entrants are targeting through disruptive new business models?

2. Many of the potential benefits of social media to provide financial inclusion to millions of more people and better service at reduced costs can be negated if regulation is imposed either directly or indirectly. In some cases, current laws have not been updated to allow organizations to realize the full potential of social media.

3. In the modern world, competition comes from everywhere. No longer do incumbents only have to worry about other innovative financial institutions; now social media platforms are moving into financial services and thousands of financial technology start-ups are being established each year.

This article is part of a series from the Global Agenda Council on Social Media, related to a white paper, The impact of digital content: Opportunities and risks of creating and sharing information online. For a broader discussion of the societal implications of digital media, read the Digital Media and Society report.